Table Of Contents

What Is Net Profit Margin?

Net profit margin is a profitability ratio that calculates how much percentage of the company’s earnings is left after deducting all the operating and non-operating expenses (also called net profit) in a given quarter/year. The net profit margin ratio is generally expressed in percentage form. However, it can also be expressed in the form of decimal points.

This profit is utilized depending on the company’s financial health and their growth trajectories. For instance, a company with expansion plans in the forthcoming year, might use their net profit to expand their infrastructure. In contrast, for a company with a sorted financial status, they might declare dividends and share the profits with their investors.

Key Takeaways

- Net profit margin is a profitability ratio that estimates the percentage of a company's earnings that remain after deducting all operating and non-operating expenses for a given quarter or year.

- This ratio is calculated by dividing the net profit by net sales.

- If the net profit margin is lower than the company's net sales, investors may question and seek further information about the company.

- If the net margin is high, investors should examine additional details to understand why the net margin is strong.

Net Profit Margin Explained

Net profit margin is the profitability ratio of an organization or company that is calculated after deducting all expenses or costs, irrespective of direct or indirect expenses. This margin can be calculated for a month, quarter or, even a year.

If the net profit margin analysis shows that the revenue from the sales of the organization is higher than the profit margin, it indicates that the company is spending more than what it generates in return per unit.

Investors can question the company and its top management based on this figure alone. Therefore, it is important for companies to figure out their profit margins before launching products and curate their marketing, distribution, and inventory costs accordingly.

For a small business, a net profit margin between 5% to 10% is considered to be a significant margin of doing business.

Video Explanation of Net Profit Margin

Formula

Let us understand the formula to calculate the net profit margin ratio before understanding anything further about the concept.

Net Profit Margin = Net Profit / Net sales * 100

We have taken "net profit" as a numerator because we want to focus on "net profit." And we are dividing “net profit” by “net sales” because we are comparing the proportion of “net profit” to “net sales.”

For example, if we have a net profit of $10 and the net sales are $100; then the net margin would be = ($10 / $100 * 100) = 10%.

- To find out the "net profit," every investor needs to look at a company's income statement. At the end of the income statement, the investor will find the "net profit."

- And to find the “net sales,” you also need to look at the income statement. To find out the “net sales,” we need to deduct any sales discount or sales return from the gross sales.

How To Calculate?

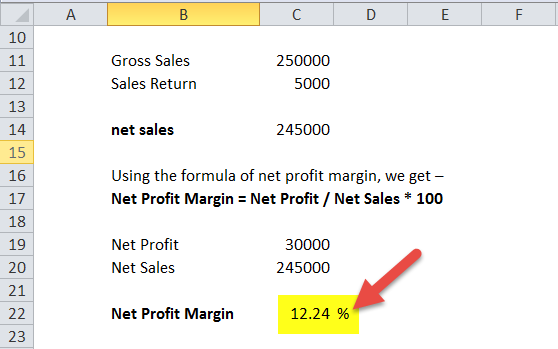

Let us understand how to calculate the net profit margin analysis using Excel sheets.

Examples

Let us understand the concept of net profit margin analysis and its importance in an organization’s indication of financial health with the help of a couple of examples.

Example #1

Uno Company has the following information –

- Gross Sales - $250,000

- Sales Return - $5000

- Net Profit for the year - $30,000

Find out the net margin of Uno Company.

- We know the gross sales, i.e., $250,000.

- The sales return is $5000.

- The net sales is = (Gross Sales – Sales Return) = ($250,000 - $5000) = $245,000.

- The net profit is also given, i.e., $30,000.

Using the formula of net margin, we get –

- Net Margin Formula = Net Profit / Net Sales * 100

- Or, Net Margin = $30,000 / $245,000 * 100 = 12.25%.

From this example, we find that the net margin of Uno Company is 12.25%. Suppose we compare this net margin with the net margin of companies under a similar industry. In that case, we will be able to interpret whether the net margin of Uno Company is good enough.

Example #2

Below is the snapshot of Colgate's Income Statement from 2007 to 2015.

- Net margin is calculated for Colgate by dividing Net Profit by Sales.

- We note that Net Margin for Colgate has been in the range of 12.5% – 15%.

- However, it decreased substantially in 2015 to 8.6%, primarily due to CP Venezuela Accounting changes.

Importance

The net profit margin ratio can be of significant use not just for the company’s top management but also for investors as it gives them an understanding of the company’s utilization of funds and its potential for growth.

- The investors can understand how much a firm has been profiting from its revenue by using the net margin formula.

- If the proportion of net profit is less than the company's net sales, then the investors would inquire why it is so and may find other important details about the company.

- Similarly, if the net margin is too much, the investors also need to see through other details to find out why the net margin is too good to be true.

- Plus, knowing the net margin formula also tells them how much net profit a firm can extract out of their net revenue.

- However, if the investors think that the net profit would increase proportionately along with the net sales, the idea is false; because there can be long-term expenses that will serve the company for a long period, and as a result, maybe the net profit would shrink. That’s why it is important to look at all of the figures before ever judging a company's performance only through this formula.